In the fast-paced world of finance and accounting, professional expertise is crucial to standing out. Whether you’re an aspiring financial analyst, accountant, or business professional, mastering financial concepts can open up numerous opportunities. Two of the most valuable qualifications that professionals pursue today are the Financial Modeling Course and the Certified Management Accountant Course. These courses equip individuals with the essential skills to excel in corporate finance, accounting, and strategic decision-making.

What is a Financial Modeling Course?

A Financial Modeling Course is designed to teach individuals how to create dynamic financial models that help businesses make informed decisions. It involves building mathematical representations of financial statements to predict future performance, assess risks, and analyze investment opportunities.

Key Benefits of a Financial Modeling Course

- Improves Decision-Making: Financial models provide insights into a company’s future growth, enabling better decision-making.

- Enhances Financial Analysis Skills: You’ll learn how to evaluate financial statements and make projections based on market conditions.

- Boosts Career Opportunities: Professionals skilled in financial modeling are in high demand in investment banking, corporate finance, and consulting.

- Teaches Excel Proficiency: Since most financial models are built in Excel, the course strengthens your spreadsheet skills.

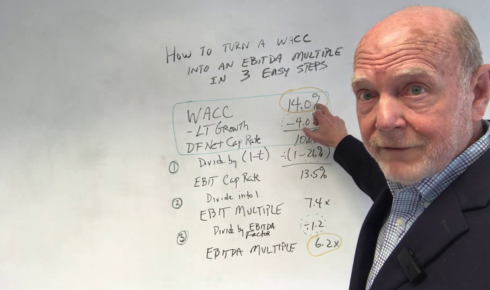

- Helps with Business Valuation: Understanding valuation methods like DCF (Discounted Cash Flow) and LBO (Leveraged Buyout) is a key takeaway.

Who Should Take a Financial Modeling Course?

This course is ideal for:

✔️ Finance professionals who want to enhance their analytical skills.

✔️ Investment bankers and equity research analysts.

✔️ Business owners and entrepreneurs looking to forecast revenues.

✔️ Students pursuing careers in finance and accounting.

With practical case studies and real-world financial analysis, this course is a game-changer for those looking to make data-driven financial decisions.

Understanding the Certified Management Accountant Course

The Certified Management Accountant Course (CMA) is a globally recognized certification that focuses on financial management, strategic planning, and cost management. Offered by the Institute of Management Accountants (IMA), the CMA credential is highly valued across industries.

Why Choose the Certified Management Accountant Course?

✔️ Global Recognition: The CMA certification is respected worldwide, opening doors to international career opportunities.

✔️ Higher Earning Potential: CMAs earn significantly more than non-certified professionals in the management accounting field.

✔️ Strong Industry Demand: Organizations prefer hiring CMAs for roles that require financial planning, risk management, and budgeting expertise.

✔️ Comprehensive Curriculum: The course covers financial reporting, strategic management, and internal controls, making it a well-rounded qualification.

✔️ Increases Career Stability: As businesses rely on financial professionals for decision-making, CMAs enjoy long-term career growth.

Key Topics Covered in the Certified Management Accountant Course

- Financial Planning & Performance Management – Understanding budgeting, forecasting, and variance analysis.

- Cost Management & Internal Controls – Learning about cost behavior, activity-based costing, and risk management.

- Corporate Finance & Investment Analysis – Evaluating investment decisions, financial instruments, and capital structure.

- Ethical Considerations in Finance – Maintaining ethical standards in financial reporting and corporate governance.

These topics prepare candidates for roles such as financial controller, cost accountant, and management accountant.

Which Course Should You Choose?

Both the Financial Modeling Course and the Certified Management Accountant Course offer immense value. Choosing between them depends on your career goals.

✔️ If you aim to work in investment banking, equity research, or financial consulting, the Financial Modeling Course is ideal.

✔️ If you want a globally recognized certification in financial management and accounting, the Certified Management Accountant Course is the right fit.

Many professionals choose to complete both courses to broaden their expertise and maximize career opportunities.

Final Thoughts

The finance and accounting world is highly competitive, and professional certification can set you apart. Whether you’re looking to sharpen your financial modeling skills or achieve CMA certification, investing in education and skill development is key to long-term success.

If you’re serious about advancing your finance career, consider enrolling in a Financial Modeling Course or a Certified Management Accountant Course today. The future of finance belongs to those who are skilled, certified, and ready to make an impact! 🚀