There’s something oddly mysterious about how businesses are valued. You’ll hear terms like “5x EBITDA” thrown around in boardrooms and broker calls like they’re universal truths. But if you’re a founder, entrepreneur, or even just someone dipping a toe into the M&A pool, this valuation lingo can sound like a foreign language. The good news? It’s not as complicated as it sounds—once you get past the buzzwords.

Let’s break down what EBITDA valuation multiple really are, how they’re calculated, and what they mean for your business. No fluff. No math degree required. Just straight talk.

What’s the Deal With EBITDA, Anyway?

Before diving into the multiples, let’s get clear on the acronym that dominates the valuation world. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. In plain English, it’s a way to measure a company’s core profitability—before all the extra accounting noise gets layered on top.

So, when investors and buyers look at a business, they don’t just care about how much you made last year after taxes. They want to know how much cash your operations generate, assuming they bring in their own tax structures, debt models, and asset strategies. That’s where EBITDA comes in. It’s the clean, neutral ground.

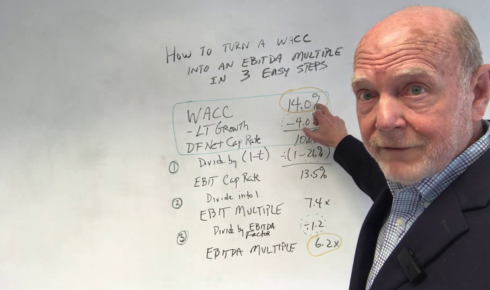

Cracking the Code: The EBITDA Multiple Formula

If EBITDA tells us how much a business earns at its core, the next question is: how many times that number is the business worth?

That’s where the EBITDA multiple formula comes into play:

Enterprise Value ÷ EBITDA = EBITDA Multiple

For example, if a company is worth $10 million and its EBITDA is $2 million, the multiple is 5x.

Simple, right? But the real art is figuring out what multiple your business deserves—and that’s where context, industry, and growth potential come in.

So… What’s a “Good” Multiple?

People love asking this, and honestly, there’s no one-size-fits-all answer. What’s considered a strong multiple in one industry might be weak in another. For example, software companies with recurring revenue often fetch sky-high multiples. Manufacturing businesses? Typically lower, but more stable.

A huge factor is risk. The lower the perceived risk, the higher the multiple. A business with solid systems, a strong brand, recurring revenue, and low customer churn will usually score better than one that’s dependent on a single founder or a few big clients.

But just to give you a rough idea, the average EBITDA multiple across industries tends to hover around 4x–6x. Of course, this can swing wildly based on the macroeconomic environment, interest rates, buyer demand, and industry growth.

Multiples in Motion: The Market is Always Shifting

Let’s talk real-world movement. Back in low-interest environments, we saw multiples balloon—especially in sectors like tech and healthcare. Buyers were flush with capital and willing to pay a premium for growth.

Then came inflation fears, rate hikes, and economic uncertainty. Suddenly, those same buyers became cautious. Multiples contracted. Deals took longer. Valuations dipped. That’s why understanding your business in the current market matters just as much as your numbers on paper.

Not All EBITDA is Created Equal

Here’s a nuance folks often miss: what goes into your EBITDA matters. There’s “raw” EBITDA—what you see on a profit and loss statement. And then there’s “adjusted” EBITDA, which adds back things like one-time expenses, owner perks, or non-operating costs.

When buyers evaluate your company, they’ll scrutinize what’s in your EBITDA and what isn’t. That’s why transparency and clean financials go a long way. A tidy P&L builds trust—and often, boosts your multiple.

And here’s a pro tip: show a trend. A consistent upward trajectory in EBITDA paints a better picture than one booming year after a flat stretch. Momentum matters.

Using Multiples to Price (or Buy) a Business

If you’re selling, your goal is to justify the highest possible multiple. That means showing operational efficiency, growth, customer loyalty, and a clear path forward. If you’re buying, it’s the opposite—you’re trying to figure out if the asking price truly reflects the business’s earning power.

One trick? Compare multiples from similar businesses in your industry. Public company data, recent private sales, and broker comps can help. Just keep in mind that private businesses often trade at lower multiples than their public counterparts—thanks to things like liquidity, size, and risk.

Valuation vs. Negotiation

Let’s get real: a multiple is just a starting point. It doesn’t lock in a price. It sets the tone for negotiation.

Maybe you’ve got a great business that’s trending upward, but the buyer is worried about future customer churn. Maybe they want to pay part upfront, part as an earn-out. Or maybe the deal structure involves debt or a seller note (a topic for another day).

The takeaway? Valuation is more art than science. Multiples are useful—but they’re not gospel.

Ending Thought: Don’t Obsess—Optimize

The goal isn’t to chase the highest possible multiple like it’s the stock market. The goal is to build a strong, sustainable business with reliable earnings. If you do that, the valuation will follow.

Multiples fluctuate. Markets shift. But a well-run company with clean books, loyal customers, and solid systems will always have options—whether it’s raising capital, bringing in a partner, or heading for a lucrative exit.

So yes, learn the formulas. Know the trends. But more importantly—run a good business.